Summary | Excerpt | Reviews | Beyond the Book | Read-Alikes | Genres & Themes | Author Bio

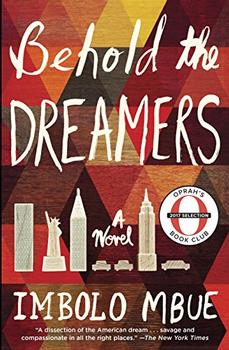

This article relates to Behold the Dreamers

Clark Edwards, one of the main characters in Behold the Dreamers, works as an executive for Lehman Brothers.

Lehman Brothers Holdings, Inc. was the fourth-largest investment bank in the United States at the time of the housing market crash (2007-2009), employing over 25,000 employees worldwide.

The company began in 1844 as a small dry-goods store in Montgomery, Alabama, owned and operated by 23-year-old Henry Lehman, an immigrant from Rimpar, Bavaria. His brother Emanuel joined the business in 1847, followed by another brother – Mayer – in 1850, and in that year the store, originally named just H. Lehman, was rechristened Lehman Brothers. During the 1850s the brothers began bartering their inventory for locally harvested cotton, a commodity that became a main driver of the United States economy during that time. When the market moved to New York City, Emanuel relocated and opened a branch office there in 1858. After the end of the U.S. Civil War, the company moved their headquarters to New York and helped finance Alabama's reconstruction.

The company began in 1844 as a small dry-goods store in Montgomery, Alabama, owned and operated by 23-year-old Henry Lehman, an immigrant from Rimpar, Bavaria. His brother Emanuel joined the business in 1847, followed by another brother – Mayer – in 1850, and in that year the store, originally named just H. Lehman, was rechristened Lehman Brothers. During the 1850s the brothers began bartering their inventory for locally harvested cotton, a commodity that became a main driver of the United States economy during that time. When the market moved to New York City, Emanuel relocated and opened a branch office there in 1858. After the end of the U.S. Civil War, the company moved their headquarters to New York and helped finance Alabama's reconstruction.

Savvy businessmen, the brothers helped found the New York Cotton Exchange in 1870, the first commodities futures trading company. As that enterprise grew they branched out, establishing a Coffee Exchange as well as a Petroleum Exchange. They added trading in railroad bonds and providing financial advice to their corporate resume, and gradually transitioned from a commodities business to a house of issue (an investment bank that underwrites initial public stock offerings). In 1887 the firm became a member of the New York Stock Exchange, finalizing the shift to a full-time, merchant banking business. In the early 20th century Lehman Brothers underwrote nearly 100 IPOs (often with their partner, Goldman, Sachs & Company), including venerable businesses such as Sears, Roebuck & Company, F.W. Woolworth Company, R.H. Macy & Company, The Studebaker Corporation, and B.F. Goodrich.

Robert ("Bobbie") Lehman, Emanuel's grandson, led the company from 1925 to 1969. He believed that consumption, not production, would determine the strength of the U.S. economy. He had his staff identify businesses in these areas that were likely to grow rapidly, and as a result Lehman Brothers became a major financer of motion picture companies such as RKO, Paramount and 20th Century Fox, as well as a backer of several emerging airlines.

The company continued to grow in spite of setbacks during the Great Depression of the 1930s and the Recession of the 1970s. They were acquired by Shearson/American Express in 1984 for $360 million, but in 1994 AmEx divested itself of the company, spinning it off as the Lehman Brothers Holdings, Inc.

The company continued to grow in spite of setbacks during the Great Depression of the 1930s and the Recession of the 1970s. They were acquired by Shearson/American Express in 1984 for $360 million, but in 1994 AmEx divested itself of the company, spinning it off as the Lehman Brothers Holdings, Inc.

Seeing opportunities for growth in the housing market, the company borrowed a significant amount of money to invest in housing-related assets in the early 2000s. It was an immensely profitable venture, but was also extremely risky; a mere 3%-4% reduction in the value of these assets would wipe out almost all the company's equity. In 2003 and 2004 they acquired five mortgage lenders including BNC Mortgage and Aurora Loan Services, companies which specialized in loans to individuals with insufficient documentation to ensure their ability to repay the money. They produced record revenues for the business at first, but as homeowners began to default on their mortgages, housing prices fell precipitously, declining over 20% from their highest point in 2006. Lehman Brothers sold BNC and Aurora, but continued underwriting more mortgage-backed securities than any other company.

The firm reported losses of $2.8 billion in the second quarter of 2008, and its stock lost 73% of its value. A week after declaring an additional $3.9 billion loss, they filed for Chapter 11 bankruptcy protection on September 15, 2008 - to date the largest bankruptcy filing in U.S. history. This prompted a sell-off in the commercial mortgage-backed securities market, which in turn caused a 500-point drop in the Dow Jones Industrial Average – with worse to come in the following weeks. Lehman Brothers, which was acquired by the British banking firm Barclays for $1.75 billion in 2008, is consequently widely credited with being responsible for the financial crisis that ensued.

Picture of Lehman brothers by ButtonwoodTree

Picture of Lehman's old NYC headquarters now owned by Barclays, by David Shankbone

Filed under People, Eras & Events

![]() This "beyond the book article" relates to Behold the Dreamers. It originally ran in August 2016 and has been updated for the

June 2017 paperback edition.

Go to magazine.

This "beyond the book article" relates to Behold the Dreamers. It originally ran in August 2016 and has been updated for the

June 2017 paperback edition.

Go to magazine.

Your guide toexceptional books

BookBrowse seeks out and recommends the best in contemporary fiction and nonfiction—books that not only engage and entertain but also deepen our understanding of ourselves and the world around us.