Summary | Excerpt | Reviews | Beyond the Book | Read-Alikes | Genres & Themes | Author Bio

This article relates to The Plea

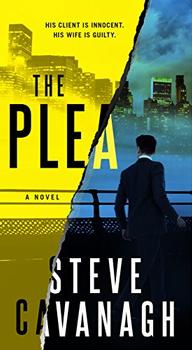

A high stakes money laundering scheme is at the core of Steve Cavanagh's legal thriller The Plea. Eight billion dollars in illicit cash is flowing through the accounts of a Manhattan law firm that enjoys a solid gold reputation. The United States federal government is hot on the case, but nailing the parties involved at just the right time is crucial to their case.

A high stakes money laundering scheme is at the core of Steve Cavanagh's legal thriller The Plea. Eight billion dollars in illicit cash is flowing through the accounts of a Manhattan law firm that enjoys a solid gold reputation. The United States federal government is hot on the case, but nailing the parties involved at just the right time is crucial to their case.

Although $8 billion (USD) may seem like a lot of money, in the grand scheme of economic crime it is dwarfed by the estimated $1-2 trillion in laundered money that is transacted worldwide each year, representing between 2% to 5% of the global GDP. But what exactly is money laundering and why is it illegal?

According to Investopia: "Money laundering is the process of creating the appearance that large amounts of money obtained from criminal activity, such as drug trafficking or terrorist activity, originated from a legitimate source. The money from the illicit activity is considered dirty, and the process 'launders' the money to make it look clean."

In the simplest terms, exchanging ill-gotten goods of any type – whether it's "fencing" stolen jewels, selling a stolen car or erasing the origin of blackmail cash – lets the criminal get away with not just the original crime but with fraud. And because once the origin of the ill-gotten gains has been obliterated it makes apprehending the criminal that much more difficult. So anyone who is complicit in such activity becomes an accomplice to crime.

According to PwC (formerly Pricewaterhouse Coopers), cybercrime – including money laundering – has become the second most reported economic crime (after asset misappropriation), affecting some 32% of businesses, and most businesses are under-prepared to deal with it. Surprisingly, money laundering was not a federal crime in the US until passage of the 1986 Money Laundering Control Act which removed limits on the amount of money involved and the individual intent. However, since 1970, financial institutions have been responsible to report all suspicious financial activity and transactions involving amounts greater than $10,000. The 2001 USA Patriot Act added teeth to money laundering enforcement by specifically addressing money with ties to terrorist groups and/or terrorism.

Given the sheer magnitude of the potential for gain, money laundering can and has lured a number of multinational financial institutions, including HSBC, Barclays, the Royal Bank of Scotland - and even the ex-president of the Vatican Bank. Needless to say, the internet has added a whole new sophistication to money laundering. Money can be laundered fairly easily via online auctions and sales. With the creation of heretofore unheard of things such as proxy servers, bitcoin and cryptocurrency, tracing the origin of illicit money has gotten much more complex.

Money Laundering

Typical money laundering scheme, courtesy of United Nations Office on Drugs and Crime

Filed under Cultural Curiosities

![]() This "beyond the book article" relates to The Plea. It originally ran in March 2018 and has been updated for the

November 2018 paperback edition.

Go to magazine.

This "beyond the book article" relates to The Plea. It originally ran in March 2018 and has been updated for the

November 2018 paperback edition.

Go to magazine.

Only when we are no longer afraid do we begin to live

Click Here to find out who said this, as well as discovering other famous literary quotes!

Your guide toexceptional books

BookBrowse seeks out and recommends the best in contemporary fiction and nonfiction—books that not only engage and entertain but also deepen our understanding of ourselves and the world around us.