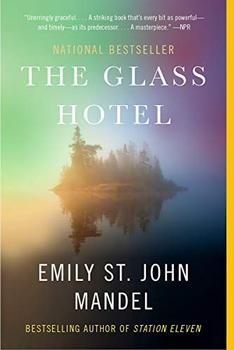

Summary | Excerpt | Reading Guide | Reviews | Beyond the Book | Read-Alikes | Genres & Themes | Author Bio

This article relates to The Glass Hotel

In Emily St. John Mandel's The Glass Hotel, the protagonist finds herself ensnared in the Ponzi scheme of a Wall Street investor. The "Ponzi scheme" takes its name from Charles Ponzi, an Italian immigrant and businessman who lived in Boston in the early 20th century. Ponzi schemes are fraudulent investments in which a business will promise above-average returns to investors under the guise that these returns are coming from above-average sales—in actuality, the funds are coming from other investors. Historically described as "robbing Peter to pay Paul," the Ponzi scheme provides the illusion of sustainable business to investors who are continuously lured in until the scheme eventually collapses.

In Emily St. John Mandel's The Glass Hotel, the protagonist finds herself ensnared in the Ponzi scheme of a Wall Street investor. The "Ponzi scheme" takes its name from Charles Ponzi, an Italian immigrant and businessman who lived in Boston in the early 20th century. Ponzi schemes are fraudulent investments in which a business will promise above-average returns to investors under the guise that these returns are coming from above-average sales—in actuality, the funds are coming from other investors. Historically described as "robbing Peter to pay Paul," the Ponzi scheme provides the illusion of sustainable business to investors who are continuously lured in until the scheme eventually collapses.

The first known Ponzi scheme was not actually orchestrated by its eventual namesake. In 1899, nearly five years before Ponzi immigrated to the U.S., a New Yorker named William Miller perpetrated one of the earliest versions of this type of scam. Miller operated a business called the Franklin Syndicate, where he promised investors 10% interest each week. Miller earned the nickname "520 Percent" because of the incredible rate of returns he promised to investors. When he was caught for having swindled $1 million (equivalent to $25 million today) he was sentenced to 10 years in prison. He served five, and on his release he opened a grocery store in Long Island.

Charles Ponzi was born in 1882 in Parma, Italy; he immigrated to America in 1903, landing in Boston. He later claimed to have gambled away all his money on the boat and arrived with $2.50 to his name. He worked odd jobs across the East Coast, getting caught up in minor criminal activity and serving a few stints in jail before moving back to Boston in 1918. It was here that he developed his plan to get rich quick when he realized that postage stamps were sold internationally at different values and that he could make a profit by purchasing these stamps in countries with weaker economies.

Ponzi then set up a new business—the Securities Exchange Company—to front what he quickly recognized could be a very profitable scam, purchasing large quantities of these postage stamps in poorer countries and redeeming them in countries with stronger currencies. He was able to lure in investors, promising returns of 50% in 45 days or 100% in 90 days. With such enticing claims, he raked in millions of dollars and was able to pay out as promised for several months, funneling new investors' money to his initial investors and so on. However, Ponzi never actually worked out how to exchange the postage for cash, nor would it have been feasible to do so on the scale that would've been required to pay the thousands of investors he had amassed.

It all came crashing down in 1920 when a furniture salesman named Joseph Daniels filed a $1 million lawsuit against him and his business fell under investigation by The Boston Post. These events caused a collapse in the company as investors started trying to pull their money out, only to find that there was no money to be had. His investors lost $20 million ($237 million today) and he was sentenced to prison where he served 14 years.

Since the collapse of Ponzi's empire, Ponzi schemes have continued to crop up in 20th and 21st century business practices—the most notorious case being that of Bernie Madoff, former chairman of the NASDAQ exchange, who was exposed during the financial crisis of 2008. Madoff conned investors out of $65 billion, which they poured into his fake hedge fund. He was sentenced to 150 years in prison.

Other notable Ponzi schemes include:

In the afterword of The Glass Hotel, Emily St. John Mandel explains that she based her character's fictional Ponzi scheme on Bernie Madoff's.

Charles Ponzi

Filed under Society and Politics

![]() This "beyond the book article" relates to The Glass Hotel. It originally ran in April 2020 and has been updated for the

February 2021 paperback edition.

Go to magazine.

This "beyond the book article" relates to The Glass Hotel. It originally ran in April 2020 and has been updated for the

February 2021 paperback edition.

Go to magazine.

Your guide toexceptional books

BookBrowse seeks out and recommends the best in contemporary fiction and nonfiction—books that not only engage and entertain but also deepen our understanding of ourselves and the world around us.